Atrium Ljungberg in two minutes

We are no ordinary property company. Buildings are naturally the basis of our operations, but our heart actually lies with the environments that people want to and can stay, now and in the future. Our main focus is on office properties, but our environments also contain housing as well as cultural, service, retail and education facilities.

As of 31 December 2024

- Listed on NASDAQ Stockholm since 1994

- Number of properties: 86

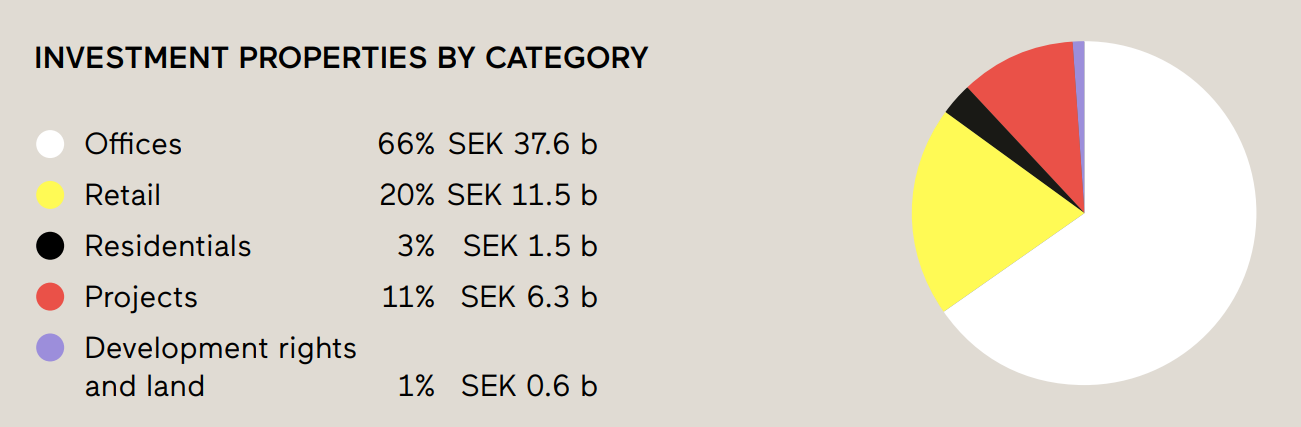

- Property value: SEK 59,8 billion

- Rental income 2024: SEK 2,988 million

- Net sales 2024: SEK 3,516 million

- Total letting area: 882,000 sqm

- Letting rate: 91 per cent

- Contracted annual rent: SEK 3,1 billion

- Number of employees: 281

- Largest owners: The Ljungberg family, the Coop Östra ek. för. and the Holmström family

Contact us